Aluminium is the most available metal on the earth crust and is widely used due to its inherent properties and its recycling nature. It has got high use in automobile, packaging, aerospace, electrical to name a few. With the rise in demand of the material from automobile sector and the OEM sector it has gained its momentum in market dynamics.

Global Aluminium market size in 2019-2020 was USD 172 billion and expected to reach USD 250 billion by year 2026-2027, exhibiting an approximate CAGR growth of 5.2%. However, Aluminium is used by automotive sectors though ages but with the rising call for introduction of the Electrical vehicles, the demand would rise multiple times owing to the light and sturdy property of the material.

Alumunium alloys used in different segments of the component manufacturing of machine parts will replace Stainless steel due to the rising cost of the stainless steel . Globally, recycling of Aluminium is being adopted due to 100% recyclable ability with minimal power consumption.

India consumes primary aluminium to approx. 2.1 million MT as per annum in 2019. India imported Aluminium Scrap approx. 14 lakh metric tons.

India’s per capita consumption of aluminium stands too low (~ 2.5 kg) compared to China (24 kg) and world average (11kg).

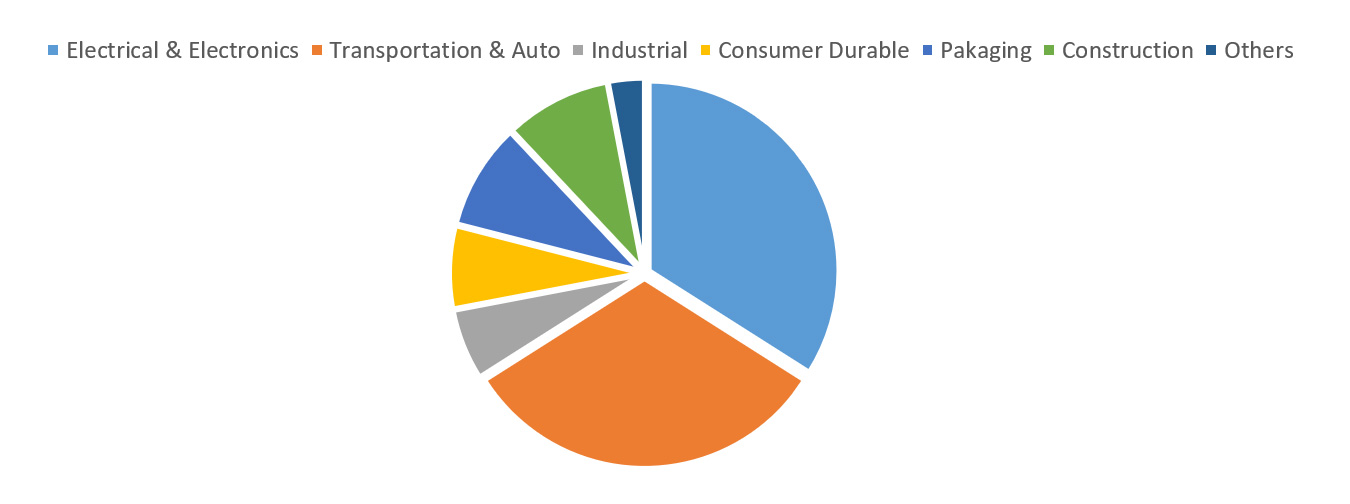

The main primary aluminium consuming sectors, as of 2018, include electrical sector (38%), transport sector (34%), construction (9%), consumer durables (7%), machinery & equipment (6%), packaging (2%) and others (4%).

Aluminium products can be manufactured using a combination of both primary and secondary aluminium depending on the specification of the final product.

Secondary aluminium producers who account for about 37 % of aluminium consumption in India.

There are more than 250 players in the unorganised secondary aluminium sector with recycling consisting of numerous SMEs spread across various states in India.

Castings account for about 70% of the recycled aluminium usage in India; Billets, re-rolling units and steel de-ox make up the balance 30%.

Transportation (mainly automobiles), followed by building & construction, consumer durable products and other industrial applications are the major users for recycled aluminium in India. The market for recycled aluminium in India has been growing at around 10% per annum during the last few years.

Typical Aluminum usage in India:

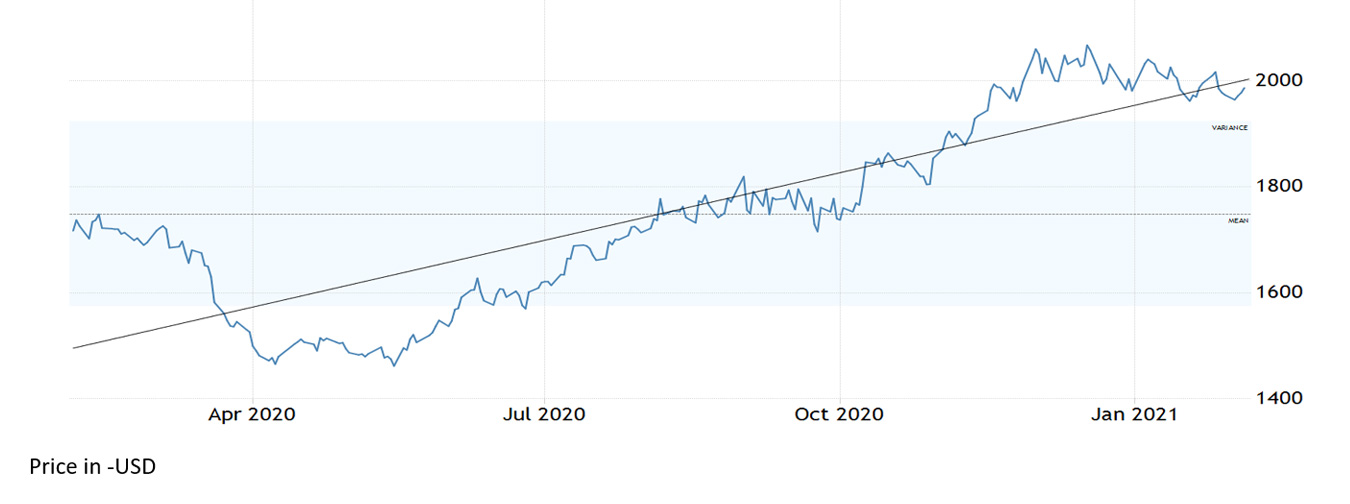

Analysis & Trends:

With steep upward movement of the prices in global market, the price correction is expected. The aluminium market may dive its nose to downward direction, with LME futures falling toward the $1,960 region amid a high level of inventories in LME and Shanghai-bonded warehouses. Such global correction may also induce the Indian Aluminium major- NALCO to revise its prices from 170 per kg prevailing.

Forecast Ahead & Conclusion :

Aluminium is expected to trade at USD 1950 per Ton by the end of this quarter of this FY at LME. With the new policy announced of vehicle scrappage in India, the demand of the aluminium and its alloys is expected to rise in days ahead and the Indian Aluminium Market is expected to remain strong bound.

MORE BLOGS

MORE BLOGSWill my technology investment fetch a good RoI? Now, this is a critical parameter and the same is ensured only if ther...

Read More

While fixing the purchase contract period of a strategic input item, there are usually two broad criteria that the procu...

Read More

Negotiations are probably as old as civilization itself; and has perhaps existed for as long as mankind has existed. Eve...

Read More